With ever changing regulations and increasing flood insurance premiums, property owners should understand that there are options available to manage their risk exposure and costs. They should also stay abreast of pending regulation changes, which could impact the design of any new construction or building improvement project.

Utilizing a knowledgeable engineering firm that understands the issues can help you lower your flood risk and the cost of your flood insurance

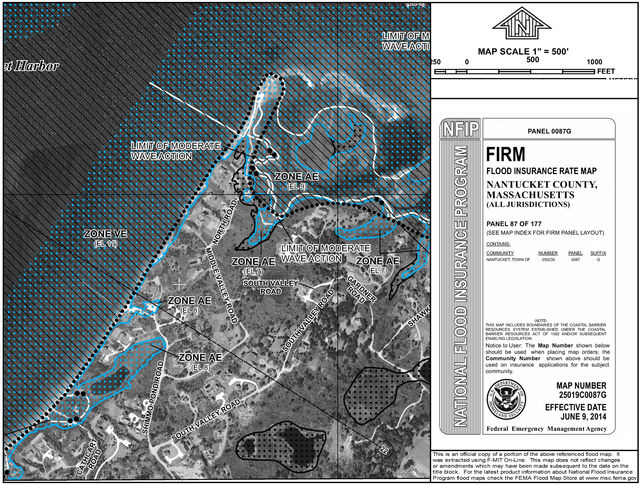

The Communities within Barnstable County adopted the Revised FEMA Flood Insurance Rate Maps (FIRMs) in July of 2014. Thousands of homeowners across Cape Cod were impacted by the flood map changes and received letters from their mortgage lenders informing them that their homes now fell within a Special Flood Hazard Area as designated on the revised Flood Insurance Rate Maps. Because their homes were newly designated as having a 1% annual risk of flooding, they were now required to purchase Flood Insurance.

The State of Massachusetts adopted the 9th Edition of the State Building Code on January 1, 2018. The regulatory standards increased for new construction or substantial improvements to those existing structures that fall within the Special Flood Hazard Areas. The State Residential Building Code has adopted higher standards set forth within the International Building Code for buildings designed within flood hazard zones. These regulation changes will significantly increase the design standards and cost of construction for homes that find themselves within Coastal AE Zones.

Are you in a FEMA Flood Zone? Visit the FEMA Flood Map Service Center and search for a current version of your area’s flood map by property address.

On the Revised Flood Maps, Special Flood Hazard Areas are now broken into Coastal High-Hazard Areas, which include not only Velocity Zones (Zone VE), but also Coastal AE Zones (Zone AE with Limits of Moderate Wave Action - LiMWA). Design requirements now mandate the design standards for foundations within these newly created “Coastal AE Zones” to match those for foundations in Velocity Zones. Design of these foundations must accommodate unobstructed flow of flood waters to a greater elevation than would be required within the AE still water flood zone. These houses are often elevated on timber piles, concrete piers, or other materials that allow waves to passed beneath the structure without damaging its supports.

Design requirements have also increased for houses within the lower “Hazard Flood Zones” (Zone AE with wave heights less than 18 inches and Zone AO, or so called “Overwash Zones”). The revised Massachusetts Building Code now requires residential buildings within these zones to design to a greater elevation than the previous edition. The newly designated “Design Flood Elevation” (DFE) is the “Base Flood Elevation” (BFE) plus 1 foot of freeboard, which places the lowest floor and utilities for new construction a foot higher than would have been required in 2017. As was the case with the 8th Edition of the Building Code, any enclosed space below the Design Flood Elevation must be made flood resistant and may only be used for storage, parking, or access. In no instance can the enclosed space below the lowest living space be constructed below ground on all four sides (no basements).

For homeowners looking to reduce flood insurance premiums and construction costs resulting from the FIRM and Building Code updates, the first step would be to retain an engineer with a good working knowledge of not only the FEMA flood zone regulations, but also State and Local ordinances. The engineer should be able to guide the property owner through design limitations and the permitting process. The first step to be taken is preparation of an Elevation Certificate. The Elevation Certificate will provide the insurance company with risk assessment information that they otherwise may not have had which, could potentially reduce an insurance premium. The Elevation Certificate will also provide the engineer with pertinent information necessary to develop mitigation strategies to reduce potential flooding risk and to further reduce insurance costs.

In order to prepare an Elevation Certificate, a survey of the property is performed to obtain the building floor elevations, ground elevations around the building, location of the utilities, flood vents, and other site improvements. This information along with information obtained from the FIRM is recorded on the Elevation Certificate. If it’s determined by this survey that the house has been improperly shown within a Flood Hazard Area, a determination can be sought from FEMA through the Letter of Map Amendment (LOMA) process.

After the Elevation Certificate has been completed and the insurance company has updated the premium, the engineer, insurance agent and a local builder can run through a cost-benefit analysis to determine:

a) Potential improvements that could be made to mitigate flood insurance costs;

b) How the improvements would reduce your risk exposure;

c) What the costs would be to make these improvements.

As a first step to help property owners mitigate the rising flood insurance costs, Coastal Engineering Co. surveys elevation around the building, location of the utilities, flood vents, and other pertinent items, and issues a stamped Elevation Certificate.

Relocating utilities above the Design Flood Elevation

Adding flood vents to the existing foundation

Elevating the house on a new flood-compliant foundation

Each property is different, so prior to planning any major building improvements, it’s a good idea to be proactive and contact a registered Professional Engineer to better understand any limitations or special building requirements.

Periodic changes to flood risk maps are inevitable, catalyzed by changes in the environment, weather patterns, and new development. Revised maps are issued by FEMA to inform property owners of changes in their community's flood zone boundaries and the risk that their property will be flooded. Knowing if your property is in a mapped flood hazard zone and at risk of being flooded are keys to protecting your investment and understanding potential limitations for making property improvements in the future.

This article originally appeared in At Home on Cape Cod Spring/Summer 2018.

Coastal Engineering Co., Inc. has more than 40 years of experience with flood prone properties and will help you navigate the effects of the flood map changes, obtain an Elevation Certificate, and consult on the options to potentially reduce your premiums. For more information, watch the video below, listen to this WPLM podcast or contact us!